Can a regional bank survive in the race for digitalization?

Artificial intelligence, marketing automation, social media, SEO, digital processes, selfservice, cost pressure, efficiency, regulations, a shortage of skilled workers, competition, increasing customer requirements… These issues, challenges, and the resulting areas of tension are affecting everyone in the market – not just banks. Digitalization is being used as a catch-all solution. So how is a small bank with limited resources supposed to survive in this highly competitive, heavily regulated shark tank? At acrevis, a small, dedicated team has spent several years successfully tackling this question.

Do one thing at a time, start small and learn from it!

Focus

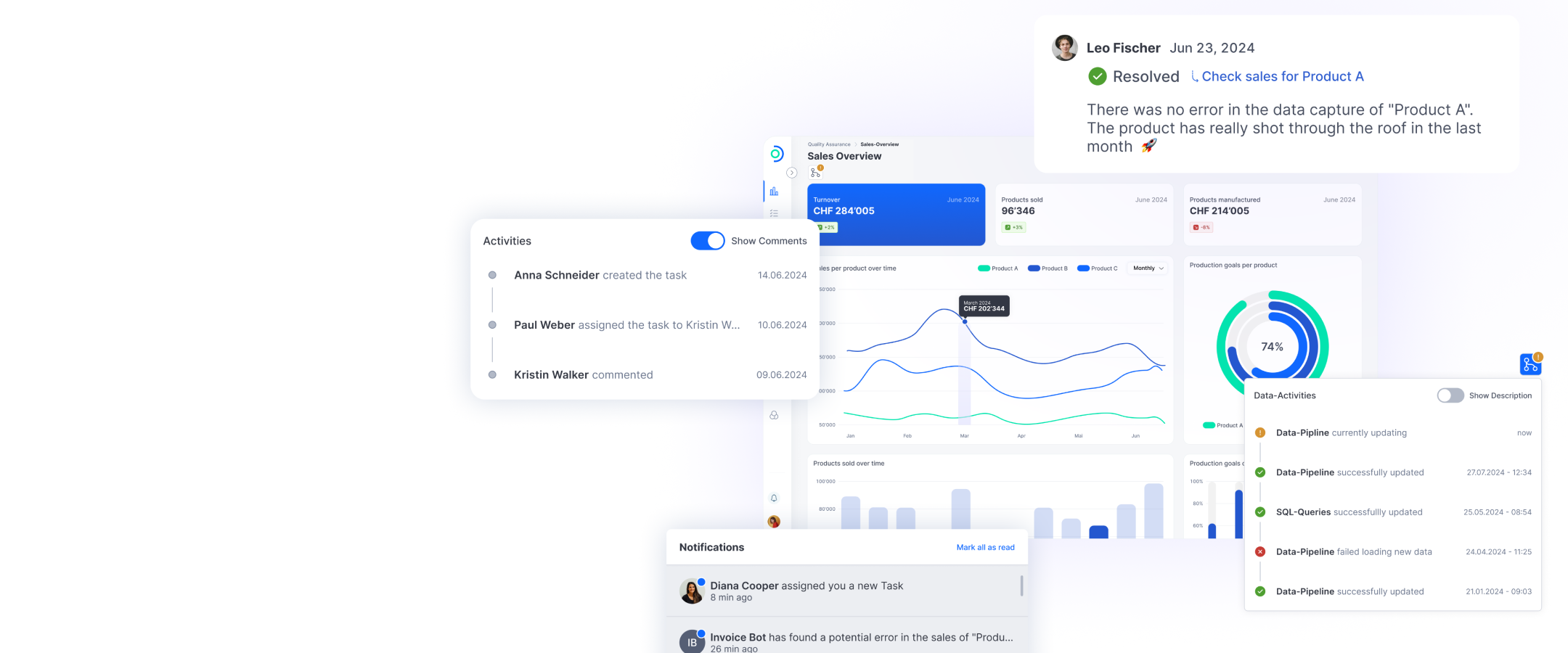

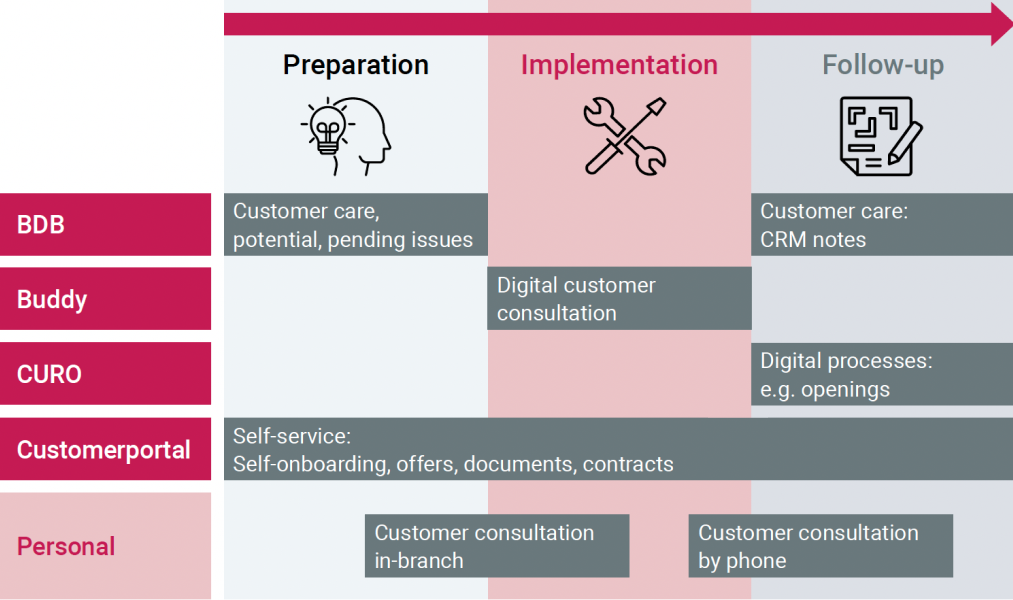

Acrevis’s digitalization strategy can be summed up in one sentence: Everything we do in terms of digitalization supports the advisory and sales process. acrevis is an advisory bank and will remain so. Face-to-face consultation is the central element and is primarily carried out by the customer advisors, with digital tools merely providing support. These give the customer advisors more time to devote themselves to their customers. We have divided our sales process into three phases: Preparation, implementation, and follow-up. We support our customer advisors with applications at every stage: an advisor dashboard (BDB), customer consultation support (Buddy), digitally managed processes (CURO), and a customer portal. We will go into this in more detail later. In the first few years, we laid the foundations with these applications and built the shell of the house, so to speak. Now we are taking care of the interior fittings, constantly adding new features and ensuring better networking.

Set priorities

When selecting the topics we want to address, we always consider the costs and benefits. Once we have completed a project, we follow up with a review to learn from it.

Start small … The MVP dilemma!

How do you prevent bad investments and undesirable developments? By involving the right stakeholders and starting small. By showing the development status as early and as frequently as possible and obtaining feedback. By learning and adjusting your direction. By not being afraid to fail sometimes. This approach minimizes the risk of bad investments, as undesirable developments are identified at an early stage. Defining the minimal viable product (MVP) is not easy. The process requires understanding, which we have created through discussions with our employees and transparent communication. Today, the MVP approach is in our DNA, and everyone would be surprised if we did things differently.

Face the challenge, seize the opportunities, be specific!

Accept the challenge

Sales management and marketing approached us with the following challenges:

- How and, in particular, when customers are addressed is changing. The customers determine the timing and initiate the communication – not the bank.

- Digital channels (website, newsletter, customer portal, e-banking, social media) are becoming even more important.

- Customer advisors should receive more support in developing the market and have their workload reduced. However, the majority of transactions will continue to be carried out by customer advisors. Data is an important element. We need ways and means to improve this data basis.

Our current e-banking system is outdated. acrevis operates this solution in a network (ESPRIT network) with other banks. No further developments will be made, as the new digital banking solution from ti&m will be introduced next year. So how do we meet the sales and marketing requirements without having to wait for a new solution?

The acrevis advisory and sales process: The personal consultation is supplemented by the advisor dashboard (BDB), customer consultation support (Buddy), digital processes (CURO), and the customer portal.

The acrevis advisory and sales process: The personal consultation is supplemented by the advisor dashboard (BDB), customer consultation support (Buddy), digital processes (CURO), and the customer portal.

Utilize opportunities

We run our website on a headless CMS solution. Based on that, we developed a customer portal. This was originally designed as a means of communication for prospects (i.e. people without access to e-banking). It only played a minor role.

As already mentioned, our old e-banking system will be replaced by a new solution in a few months’ time and is therefore no longer being developed. As an interim solution, we have modified the customer portal and placed it in front of the e-banking system. We are standardizing the login, which means that customers can access the customer portal with their e-banking login and can already use functions such as self-services. What is not ideal is that there is no customer portal on the mobile app.

Be specific

With our customer portal we can:

- provide self-services such as change of address, customizing authorizations or exchange of documents including digital signatures,

- support marketing automation with customer-specific teasers that can generate leads via a landing page, for example,

- make information such as stock market prices or mortgage rates easier to find,

- improve customer support with an AI chatbot that provides meaningful answers to customer questions or with a video support solution.

Well-intentioned ideas have also already failed:

- For customers who use e-banking exclusively for business purposes, the customer portal offers little added value. They can now skip that step.

- We have changed the original UI principle because we realized that customers want to see other functions and services at the top.

- It is not easy to generate enough attention with an individual teaser so that customers react to it.

We still have many ideas in the pipeline and are constantly working on implementing and integrating further services and aids.

Where does ti&m help us?

The ESPRIT network, which also includes acrevis, will replace its existing e-banking and mobile banking system with the ti&m solution. The target date for implementation is the end of 2025. From that point on, we will migrate our services to ti&m’s engagement platform, which is based on ti&m’s banking solution. We are already building our solutions so that they can be easily adopted at a later date. This will give us a modern, integrated, and mobile-ready solution that will enable us to address our customers even better.

ti&m Special «digital banking»